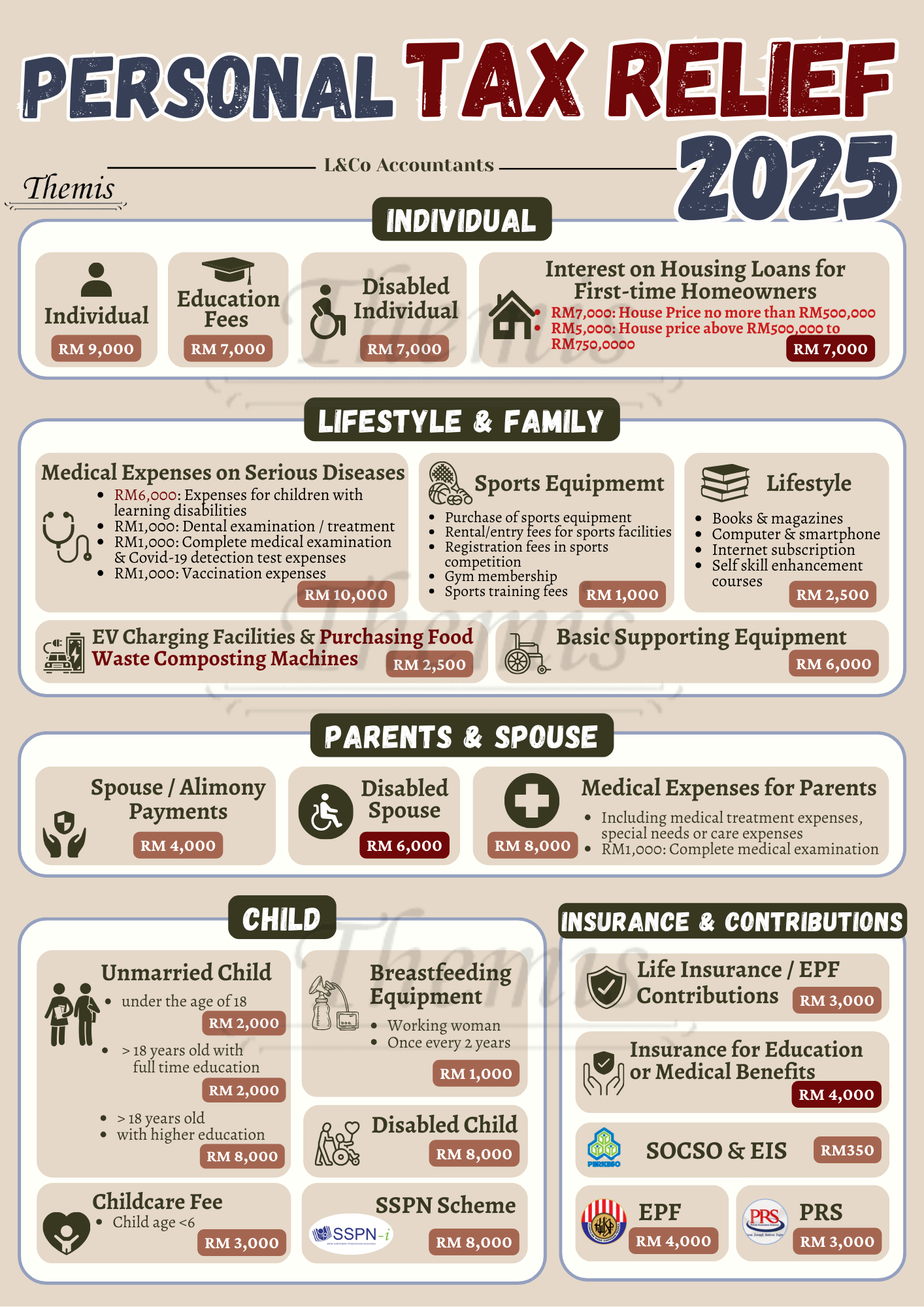

Personal Tax Relief 2025

|

.gif) |

| |

Details of Personal Tax Relief 2025

|

|

|

|

| |

Maximize Your 2025 Tax Savings – Here's Your Personal Tax Relief Summary!

**Any changes is subjected to LHDN’s announcement** |

| |

Tax Relief for Individual

|

| (i) Individual RM 9,000 |

| |

| (ii) Education RM 7,000 |

- Education fee for tertiary level or postgraduate level

- Personal upskilling / self-enhancement course (Limit to RM 2,000) [Extended to Year 2026]

|

| |

| (iii) Disabled Individual RM 7,000 |

| |

| (iv) Interest on Housing Loans for First-time Homeowners RM 7,000 |

- RM 7,000: House Price no more than RM 500,000

- RM 5,000: House Price above RM 500,001 to RM 750,000

|

| |

Tax Relief for Lifestyle & Family

|

| (i) Medical Expenses on Series Diseases RM 10,000 |

- Cost of medical expenses on serious diseases for self, spouse or child

- Cost of fertility treatment for married couples

- Dental examination or treatment for self, spouse or child

- Complete medical examination (Limit to RM 1,000)

- Vaccination expenses (Limit to RM 1,000)

- Expenses for children with learning disabilities (Limit to RM 6,000)

o Autism

o Attention Deficit Hyperactivity Disorder (ADHD)

o Global Developmental Delay (GDD)

o Intellectual Disability

o Down Syndrome

o Specific Learning Disabilities

|

| |

| (ii) Sport Equipment RM 1,000 |

- Purchase of sports equipment

- Rental/entry fees for sports facilities

- Registration fees in sports competition

- Gym membership

- Sports training fees

|

| |

| (iii) Lifestyle RM 2,500 |

| |

- Books & Magazines

- Computer & smartphone

- Broadband

- Self-skill enhancement courses

|

| |

(iv) Expenses related to Electric Vehicle (EV) charging facilities & Purchasing Food Waste Composting Machines RM 2,500

- o For Electric Vehicle (EV) charging facilities including installation, rental, hire-purchase of equipment or subscription fees [Extended to year 2027]

|

| |

| (v) Supporting Equipment RM 6,000 |

- For disabled individual, spouse, child or parent

|

| |

Tax Relief for Parents

|

| (i) Spouse / Alimony RM 4,000 |

- For spouse without income

- Alimony of former wife (Agreement needed)

|

| |

| (ii) Disabled Spouse RM 6,000 |

| |

| (iii) Medical expenses for parents RM 8,000 |

| |

- Including medical treatment expenses, special needs or care expenses

- Complete medical examination (limit to RM 1,000)

|

| **Tax Relief for caring for parents has been removed** |

| |

Tax Relief for Child

|

| (i) Unmarried Child Relief |

- Child aged below 18: RM 2,000

- Child aged 18 and above with following condition: RM 2,000

- Receiving full time education

- Child aged 18 and above with following condition: RM 8,000

- Receiving higher education, diploma and degree onward

|

| |

| (ii) Breastfeeding Equipment RM 1,000 |

- Limited to female taxpayers, and the child must be under 2 years old

- Can be claimed once every 2 years

|

| |

| (iii) Childcare or Preschool Education Fees RM 3,000 |

- Limited to children under 6 years old

- The childcare centres or kindergarten must be registered with the Department of Social Welfare (SWD) or the Ministry of Education (MOE)

|

| |

| (iv) Disabled Child for aged under 18 |

| |

| (v) Net Saving in SSPN's scheme RM 8,000 |

- Net saving in National Education Saving Scheme (SSPN) for child

|

| |

Tax Relief for Insurance & Contributions

|

| (i) PRS RM 3,000 (Extended to Year 2025) |

- Private Retirement Scheme (PRS) contributions and Deferred annuity scheme premium

|

| |

| (ii) EPF RM 4,000 |

| |

| (iii) SOSCO & EIS RM 350 |

| |

| (iv) Education or Medical Insurance RM 4,000 |

- Medical benefit or Insurance premium for education

|

| |

| (v) Life Insurance / EPF Contributions RM 3,000 |

|

| Contact us if you have any problems! |

| |